How Neobanks are shaping the future of banking

Are Neobanks the new cool kids on the banking block?

Neobanks have been instrumental in addressing India’s credit under-penetration, disbursing over a massive ₹12,000 crore till 2024. With the number of users expected to swell up to 50 million by 2026 from the existing 15-20 million, India’s banking sector is poised for a revolution.

Hence, it comes as a surprise that just a decade ago, there was no evidence of the banking revolution that was about to come. In this edition of The Conquest Communiqué, let’s explore how Neobanks arrived and took the Indian market by storm.

2008 Financial Crisis Weakens Public Confidence

Traditional banks lost public confidence post the World Financial Crisis of 2008. That’s because in order to recoup their own losses, banks made it harder for individuals to borrow money, also charging higher fees for those who did.

This, combined with the imposition of stricter regulations within the banking sector, gave the opportunity to tech-driven, consumer-friendly models that offered more transparency, lower fees, and less financial jargon during credit lending.

During this change in the banking landscape, one such model that emerged was that of Neobanks, also known as Challenger Banks. Their digital-only models not only eliminated geographical barriers but also made the onboarding process much more streamlined by eliminating paperwork, as opposed to traditional banks’ cumbersome procedures.

Neobanks get a visibility boost

In India, the emergence of Neobanks can be traced back to around 2015, with the establishment of early players like Fino, PayTech, and IDFC Bank's Anytime. However, it was with the entry of telecom companies like Airtel with Airtel Payments Bank in 2017 that neobanks came into the limelight.

Additionally, around this time, the introduction of UPI (Unified Payments Interface) in the digital payments sector drastically increased the visibility and potential of neobanks.

The COVID-19 pandemic, which forced a shift towards digital banking, further accelerated their growth.

The first wave of neobanks included players like Niyo and Open. It was around 2020 that the sector witnessed rapid growth with the onset of more players like Jupiter, RazorpayX, etc.

Neobanks become a massive hit

Presently, the number of neobank users in India is estimated to be around 15-20 million with the number expected to grow to over 50 million by 2026. How did they do this? By addressing the visible flaws in the traditional banking model and personalizing services.

No physical presence and lower operating costs translated into better interest rates and lower transaction fees for customers. The rapid increase in smartphone penetration and internet services allowed a larger population to access services provided by neobanks.

These offerings were enhanced with innovations such as AI and ML which allowed for personalized services.

Neobanks targeted specific demographics or communities such as Millennials and Gen Z with a brand image that resonated with these segments. For instance, players like NiYO catered to specific issues like international travel by offering solutions such as a global card, which negates the need to buy a Forex card during foreign travel.

Open, founded by Mabel Chacko, focused on serving small and medium-sized enterprises and startups by providing them with business accounts, automated accounting, and expense management.

But there were many challenges along the way:

The rapid growth of neobanks, also brought them into the eyesight of regulatory bodies such as the RBI and SEBI, which began imposing restrictions, thus hindering their services.

The RBI emphasized the need for neobanks to have a physical presence, with in-person client services and issue resolution. Neobanks also do not possess full banking licenses, which prevents them from providing full-fledged banking services.

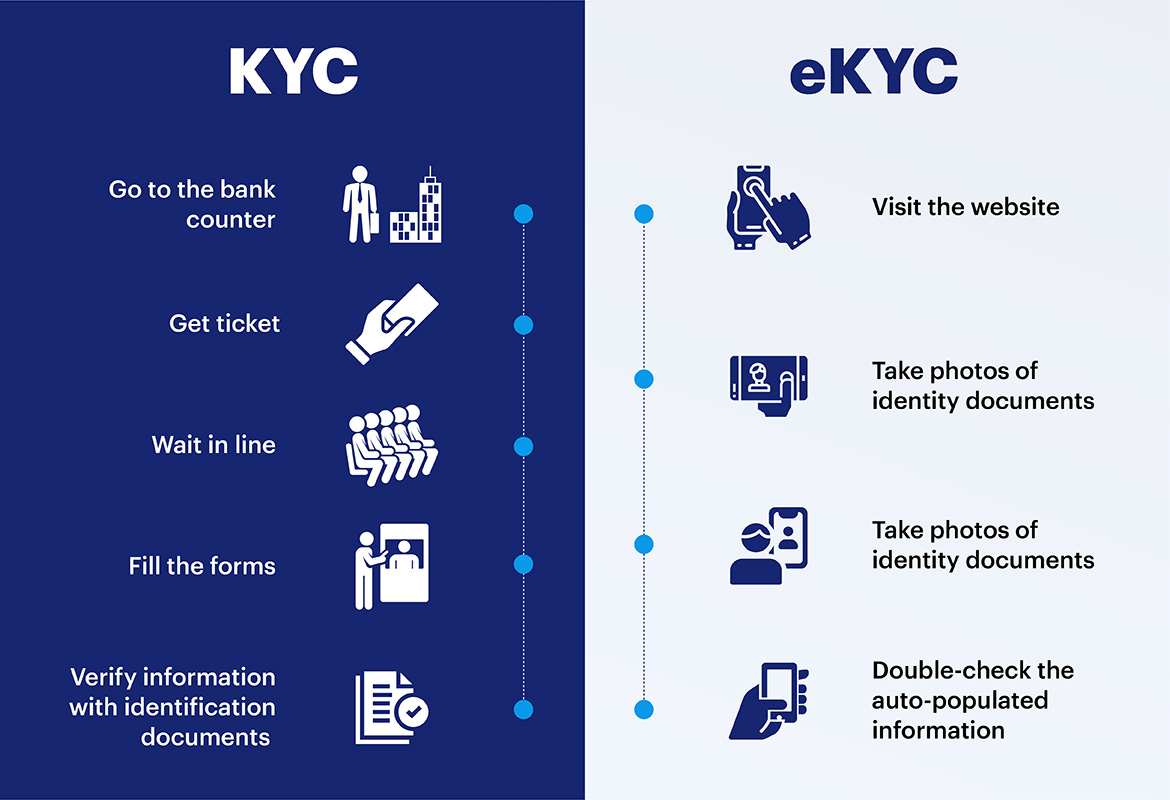

Often KYC/ AML compliances which are regulatory requirements in the banking sector are a cumbersome process and require physical verification which poses a challenge for neobanks aiming for seamless digital onboarding.

Overcoming these challenges

To overcome regulatory hurdles, neobanks often outsource banking operations to individuals, traditional banks with banking licenses, or partner with Non-Banking Financial Corporations (NBFCs). They leverage partner banks’ financial stability to maintain capital adequacy ratios and meet regulatory expectations. For instance, Niyo partners with IDFC FIRST Bank to offer its NiyoX digital savings account and collaborates with Equitas Small Finance Bank, a prominent NBFC.

They have also leveraged the RBI’s Regulatory Sandbox, wherein the RBI provides a controlled environment with relaxation on certain mandatory regulations, to navigate these regulatory hurdles.

Neobanks also often partner with reg-tech firms to digitize ID verification processes. For example, Open collaborates with Onfido, using AI-driven e-KYC for onboarding and real-time transaction monitoring with Onfido’s AML software to detect anomalies and generate alerts for suspicious transactions.

To offer banking experiences without a full license, neobanks use Prepaid Payment Instruments (PPIs) like smart cards, paper vouchers, and mobile wallets. These tools, under less stringent regulatory frameworks, enable quick product launches with minimal legal hurdles. An example is Paytm Payments Bank, which uses PPIs like prepaid wallets to provide services such as savings accounts and fixed deposits.

Understanding consumer psychology

Discerning the differing consumer psychologies which vary significantly between countries like India and the USA is essential for neobanks, in order to tailor their strategies to cater to both demographics.

In India, customers historically trust well-established brick-and-mortar banks as they often associate physical presence with security and reliability and have general apprehension with digital-only platforms, concerned with issues like cyber-fraud and data breaches.

The Indian consumer is also much more sensitive to fees on transactions and other charges and would rather prefer banks that offer low-cost services.

In India, while the newer generation is more tech-oriented, a substantial portion of the population has limited digital and financial literacy, and thus easy-to-use and intuitive services are in need which neobanks have consistently been providing over the years.

How were these concerns addressed?

Neobanks leverage the credibility of their partner banks to reach the apprehensive customer base. Their lower interest rates and less to no transaction fees attract the fee-sensitive Indian consumer base and give them value for their money.

Several Indian neobanks including IndusInd Neo and Kotak 811 also offer financial literacy modules within their apps. This educates users on responsible credit usage. They also provide vernacular language support and focus on offering easy-to-understand financial products, catering to the Indian market with varying levels of financial literacy.

Comparing this to the banking sector in countries like the USA, where the average American customer is generally more comfortable with digital-only financial services and longs for a superior customer experience, hassle-free transactions, robust security measures, and data protection protocols.

To address this, neobanks often focus on higher quality customer support, user experience design, and instant and round-the-clock banking services which include seamless integration with other platforms such as investment tools, personalized financial products, etc.

American consumers also prefer instant gratification and credit for everyday needs. Neobanks such as Chime offer features like “SpotMe” which is a debit card overdraft service that advances a small amount of money without any fee, to address this need.

Exploiting varying credit trends in India and the USA

We know that credit penetration is much higher in the USA, and credit history ( usually calculated by the FICO scoring model) is much more established and plays a major role in loan approval. Further, established credit bureaus like Equifax and Experian collect consumer credit information and provide reports to these lenders to assess whether a person is eligible for credit. Whereas in India, a large proportion of the population especially younger demographics lack a formal credit history so, often this creates an issue with addressing creditworthiness.

But, how do Neobanks assess creditworthiness for the underbanked segments in both cases?

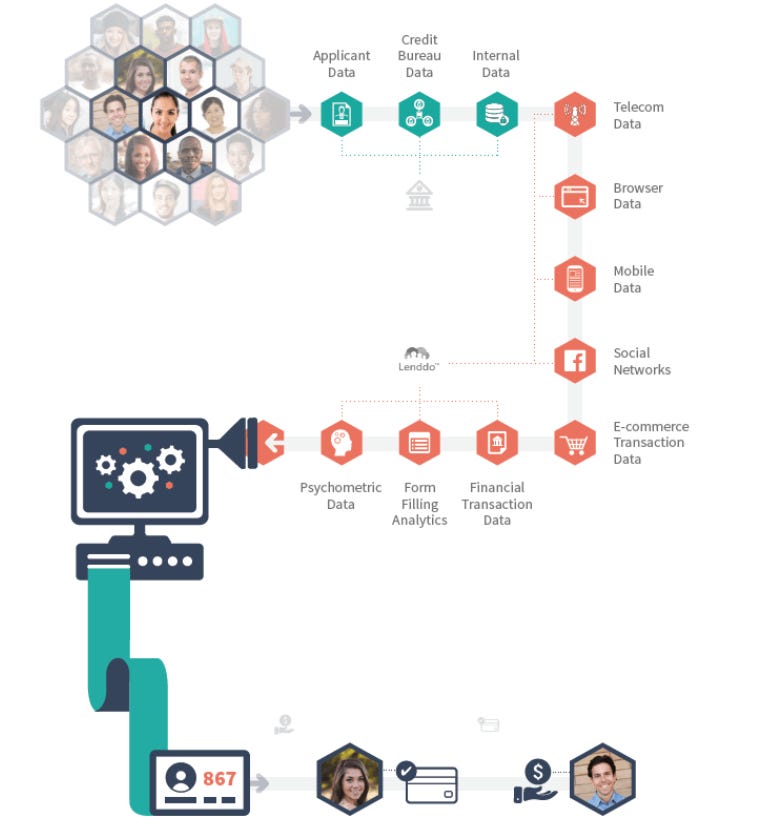

In India, neobanks such as ZestMoney have focused on developing scoring models based on mobile banking behavior, transaction history, and social media usage to determine loan approval to ensure credit access for the underbanked.

Whereas in nations like the USA, Neobanks often try to go beyond FICO scores and leverage other data sources like cash flow analysis to assess creditworthiness.

Lobbying for favorable regulations

Neobanks have taken the Indian financial landscape by storm, but at the same time their exponential growth has attracted the attention of regulatory bodies like the RBI which often impose stringent regulations that may affect their effective functioning

Neobanks collaborate with industry associations like the Digital Lender's Association of India (DLAI) and the Internet and Mobile Association of India (IMAI) to engage with regulatory authorities. These associations influence regulations, advocating for a balanced approach that supports the growth of digital lenders and neobanks while streamlining KYC processes.

As a result of these efforts, on 9th January 2020, the RBI permitted a Video-based Customer Identification Process (V-CIP) for KYC compliance, along with Aadhaar-based e-KYC and video KYC, further simplifying the onboarding process.

The Road Ahead, for the Future

Neobanks have revolutionized the financial landscape in India by ensuring financial inclusion and accessibility to all. However, these digital-only banks still face various challenges such as the ever-evolving banking regulations, cybersecurity threats, and the constant need to stay up-to-date technologically.

In a market like India, building trust among the cautious Indian consumer who trusts traditional brick-and-mortar banks is still a major challenge, even though Neobanks has already adopted measures for the same. However, their future looks promising. Their consumer-centric model, capability to provide personalized experiences, and reaching the under-banked sectors will eventually cement their place as key players in the Indian banking ecosystem.